Table of Contents

- What Does It Mean To Switch Health Plans?

- Why Switching Health Plans Matters For Your Coverage

- How Health Insurance Plans Are Structured And Compared

- Key Considerations When Evaluating New Health Plans

- Real-World Scenarios: Understanding The Impact Of Your Choices

Quick Summary

| Takeaway | Explanation |

|---|---|

| Switch based on needs | Evaluate changes in personal health or financial situations to determine if a switch is necessary. |

| Analyze current plan usage | Review healthcare utilization to assess whether your current plan meets your needs effectively. |

| Financial implications matter | Compare costs like premiums and deductibles to avoid unexpected expenses from plan choices. |

| Network access is critical | Ensure your preferred healthcare providers participate in the plan’s network for better access to services. |

| Consider life changes | Major life events may require reevaluation of your health plan compatibility with your new circumstances. |

What Does It Mean to Switch Health Plans?

Switching health plans is more than just changing insurance providers. It represents a strategic decision to adjust your healthcare coverage based on evolving personal health needs, financial circumstances, or dissatisfaction with current services. Learn more about healthcare coverage options to make an informed choice.

Understanding the Basics of Health Plan Transitions

Healthcare coverage is not static. Individuals and families frequently reassess their plans to ensure they receive optimal medical protection. Switching health plans involves carefully evaluating your current insurance and selecting an alternative that better matches your healthcare requirements.

The process encompasses several critical considerations:

- Analyzing current healthcare utilization

- Comparing coverage benefits and costs

- Assessing network availability of preferred healthcare providers

According to Kaiser Family Foundation research, approximately 15% of Americans change their health insurance annually. This statistic underscores the dynamic nature of healthcare decision making.

Motivations Behind Switching Health Plans

People switch health plans for various compelling reasons. Financial considerations often drive these decisions, with individuals seeking more affordable options or better coverage. Other motivations include:

- Significant life changes like marriage or job transitions

- Dissatisfaction with current plan’s provider network

- Desire for more comprehensive medical coverage

Understanding these motivations helps individuals approach health plan transitions strategically, ensuring they select coverage that genuinely meets their unique healthcare needs.

Why Switching Health Plans Matters for Your Coverage

The right health insurance plan can dramatically impact your medical care quality, financial stability, and overall healthcare experience. Discover strategies for optimal health coverage to protect your well being.

Financial Protection and Cost Management

Health plan selection directly influences your out-of-pocket expenses and financial protection. Switching plans strategically can help you manage healthcare costs more effectively. The wrong plan might lead to unexpected medical bills or higher annual expenses.

Key financial considerations include:

- Annual deductible amounts

- Monthly premium costs

- Maximum out-of-pocket spending limits

- Prescription drug coverage expenses

According to Centers for Medicare and Medicaid Services research, individuals who carefully compare health plans can save up to 20% on annual healthcare expenditures.

Comprehensive Healthcare Access

Your health plan determines which medical professionals you can see, what treatments are covered, and how quickly you can access specialized care. A well-chosen plan ensures comprehensive healthcare access tailored to your specific medical needs.

Important factors to evaluate include:

- Network of available healthcare providers

- Specialist referral processes

- Coverage for specific medical conditions

- Telehealth and preventive care options

Understanding the nuanced differences between health plans empowers you to make informed decisions that protect your health and financial well-being.

How Health Insurance Plans Are Structured and Compared

Understanding the intricate landscape of health insurance requires a comprehensive view of how different plans are constructed and evaluated. Learn about essential health insurance coverage to make informed decisions about your healthcare protection.

Basic Plan Structure and Categories

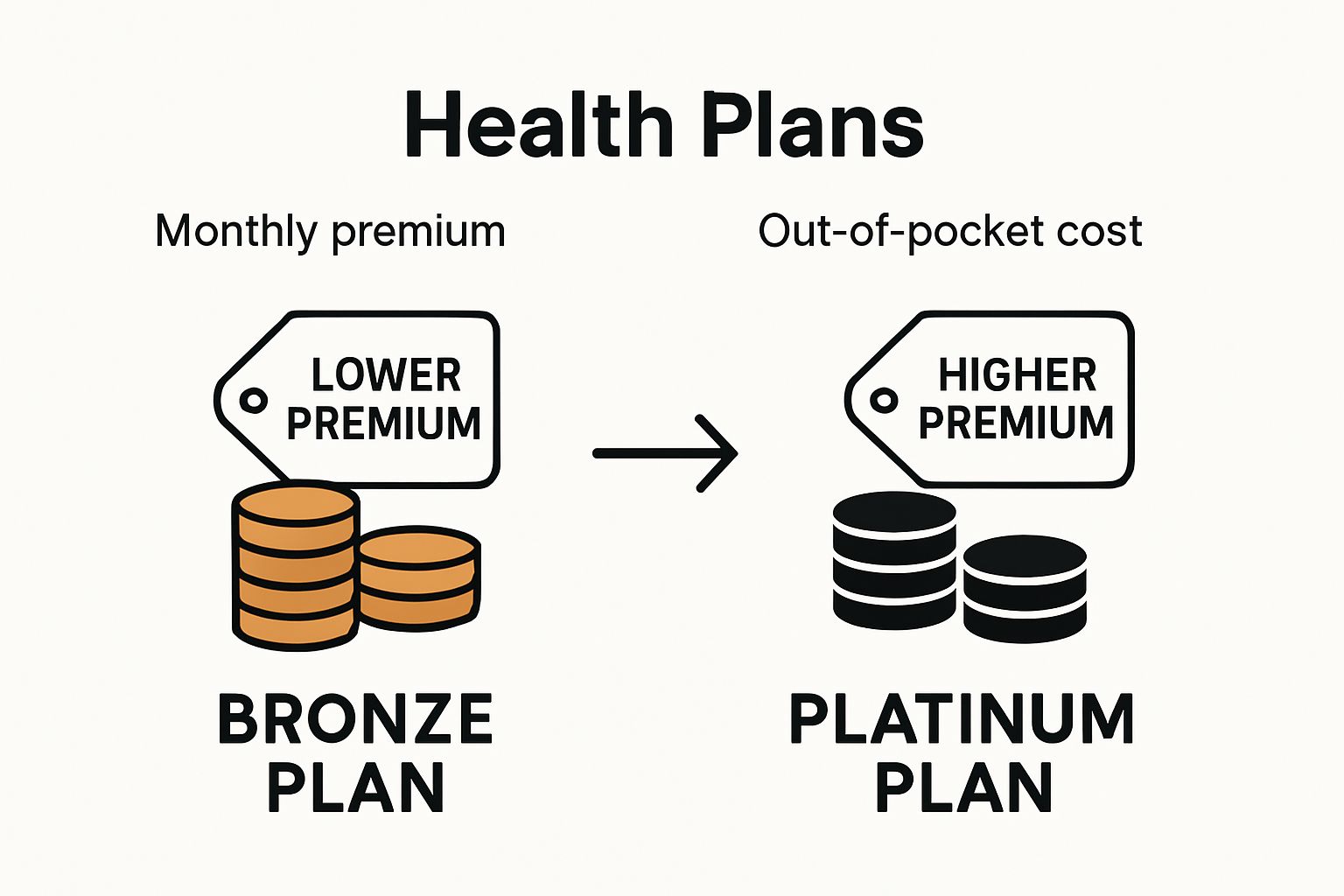

Health insurance plans are typically organized into standardized categories that help consumers compare coverage levels and costs.

These categories range from basic, lower-premium plans with higher out-of-pocket expenses to comprehensive plans with more extensive coverage.

These categories range from basic, lower-premium plans with higher out-of-pocket expenses to comprehensive plans with more extensive coverage.

Key plan categories include:

Below is a comparison table summarizing the key characteristics of common health insurance plan categories to help you assess which coverage level may best suit your needs.

| Plan Category | Monthly Premiums | Out-of-Pocket Costs | Coverage Extensiveness |

|---|---|---|---|

| Bronze | Lowest | Highest | Basic coverage; greater costs if you need care |

| Silver | Moderate | Moderate | Balanced between cost and coverage |

| Gold | Higher | Lower | More medical costs covered, higher premiums |

| Platinum | Highest | Lowest | Most comprehensive coverage, least out-of-pocket |

- Bronze: Lowest monthly premiums, highest out-of-pocket costs

- Silver: Moderate premiums and cost-sharing

- Gold: Higher monthly premiums, lower out-of-pocket expenses

- Platinum: Highest monthly premiums, lowest out-of-pocket costs

According to Kaiser Family Foundation research, the majority of Americans receive health insurance through employer-sponsored plans, which often mirror these standardized categories.

Critical Comparison Factors

When comparing health insurance plans, several fundamental elements determine their overall value and suitability. Individuals must carefully evaluate these factors to select a plan that matches their healthcare needs and financial situation.

Important comparison considerations include:

- Monthly premium costs

- Annual deductible amounts

- Network of healthcare providers

- Prescription drug coverage

- Additional benefits like dental or vision care

By understanding these structural elements and comparison factors, consumers can more effectively navigate the complex world of health insurance and select a plan that provides optimal protection and value.

Key Considerations When Evaluating New Health Plans

Selecting the right health plan requires a strategic approach that balances personal healthcare needs with financial constraints. Learn how to maximize your healthcare coverage and make informed decisions.

Personal Health Profile Assessment

Your individual health status and anticipated medical requirements form the foundation of effective health plan selection. Understanding your unique healthcare needs helps identify the most suitable coverage options.

Critical personal health factors to evaluate include:

- Frequency of medical visits

- Current chronic condition management needs

- Prescription medication requirements

- Anticipated medical procedures or treatments

- Family medical history

According to National Health Interview Survey research, individuals with complex medical histories benefit significantly from comprehensive plans that offer broader network coverage and lower out-of-pocket expenses.

Financial Compatibility and Cost Analysis

Beyond medical coverage, a health plan must align with your financial capabilities. Analyzing total healthcare expenses involves examining multiple cost dimensions beyond monthly premiums.

Key financial considerations include:

- Monthly premium amounts

- Annual deductible levels

- Maximum out-of-pocket spending limits

- Copayment and coinsurance structures

- Potential tax credits or subsidies

Carefully comparing these financial elements ensures you select a health plan that provides robust medical coverage without causing undue financial strain.

Real-World Scenarios: Understanding the Impact of Your Choices

Health insurance decisions extend far beyond theoretical considerations, directly influencing personal healthcare experiences and financial outcomes. Learn strategies for effective health insurance enrollment to make informed choices.

Life Stage and Health Plan Transitions

Different life stages demand unique health insurance strategies. Young professionals, growing families, and seniors encounter distinct challenges when selecting and transitioning between health plans.

Typical transition scenarios include:

- Career changes triggering employer health plan shifts

- Marriage or divorce affecting family coverage

- Reaching Medicare eligibility age

- Experiencing significant health status changes

- Relocating to a new geographic region

According to American Journal of Public Health research, approximately 40% of Americans experience a major health insurance transition within a five-year period.

This table summarizes typical life transitions that often lead people to switch health insurance plans, along with relevant statistics from the article.

| Life Event or Transition | Typical Health Plan Impact | Relevant Statistic |

|---|---|---|

| Career change | New employer plan, coverage shift | 15% of Americans switch health plans annually |

| Marriage or divorce | Adjust single/family coverage | 40% experience a major transition in 5 years |

| Medicare eligibility (age) | Move to Medicare coverage | |

| Significant health status change | Need for more/different coverage | |

| Relocation to a new region | Change in plan availability |

Financial and Health Consequences of Plan Selection

Your health plan choice can have profound implications beyond monthly premiums. Selecting the wrong plan may lead to substantial unexpected expenses or limited access to necessary medical treatments.

Potential consequences of suboptimal plan selection include:

- Unexpectedly high out-of-pocket medical expenses

- Limited access to preferred healthcare providers

- Insufficient coverage for chronic condition management

- Potential treatment delays or financial strain

- Reduced preventive care opportunities

Carefully evaluating real-world scenarios helps individuals anticipate potential challenges and select health plans that provide comprehensive protection and financial stability.

Ready to Take the Stress Out of Switching Health Plans?

Trying to switch health plans can feel overwhelming. You might worry about missing deadlines, losing access to your trusted doctors, or accidentally choosing a plan that doesn’t fit your budget or health needs. As described in the article, issues like out-of-pocket costs, network restrictions, and confusing plan comparisons can leave anyone feeling uncertain or frustrated. If you want a smoother transition and fewer surprises, you need the right support and information at your side. Visit our Open Enrollment Resources section to find practical tips and guidance dedicated to situations just like yours.

Don’t let doubt slow you down. At GenerationHealth.me, we make comparing health plans simple and stress-free. Get instant access to the tools, expert advice, and personalized support you need to choose the best coverage for your life. Explore our website today and make your next health plan switch with confidence. For North Carolina residents, see even more options with our NC Health Insurance Carriers Guide. Take control of your healthcare now and move forward with peace of mind.

Frequently Asked Questions

What are the key reasons for switching health plans?

Switching health plans may be motivated by financial factors, significant life changes, dissatisfaction with current provider networks, or the need for more comprehensive medical coverage.

How do I evaluate if I need to switch my health plan?

To determine whether to switch your health plan, assess your current healthcare utilization, consider changes in your health needs, and evaluate the coverage benefits and costs of your existing plan compared to alternatives.

What factors should I consider when comparing different health plans?

Key comparison factors include monthly premium costs, annual deductible amounts, provider network availability, prescription drug coverage, and additional benefits like dental or vision care.

How can switching health plans affect my financial situation?

Switching health plans can lead to better financial protection by reducing out-of-pocket expenses, which may help manage healthcare costs more effectively and potentially save individuals up to 20% on annual healthcare expenditures.