Table of Contents

- What Is The Role Of Insurance Agents?

- Why Insurance Agents Are Essential For Healthcare Choices

- How Insurance Agents Navigate Policies And Plans

- Key Concepts In Understanding Insurance Agents’ Functions

Quick Summary

| Takeaway | Explanation |

|---|---|

| Insurance agents simplify complex insurance processes. | They help individuals understand health coverage options, making informed decisions easier. |

| Personalized recommendations are vital. | Agents assess individual needs and financial situations to provide tailored insurance plan suggestions. |

| Continuous support enhances client experience. | Agents assist clients beyond enrollment, guiding them through renewals, claims, and changing healthcare needs. |

| Agents bridge the information gap in healthcare. | They decode complicated insurance terms, helping clients identify potential coverage gaps and match needs with plans. |

| Understanding agent types improves consumer choices. | Knowing different agent classifications helps consumers choose the right expert for their specific insurance needs. |

What is the Role of Insurance Agents?

Insurance agents are specialized professionals who serve as critical intermediaries between individuals seeking health coverage and insurance providers. According to the U.S. Bureau of Labor Statistics, these professionals help clients navigate the complex landscape of health insurance by providing personalized guidance and expertise.

Understanding the Core Functions

The primary role of insurance agents extends far beyond simple sales transactions. These professionals act as knowledgeable consultants who help individuals make informed decisions about their healthcare coverage. Their responsibilities include:

- Analyzing individual healthcare needs and financial situations

- Comparing multiple insurance plans and coverage options

- Explaining complex insurance terminology and policy details

- Providing personalized recommendations based on specific client requirements

These professionals possess in-depth knowledge about various insurance products, enabling them to match clients with plans that offer the most appropriate coverage at reasonable prices.

Navigating Healthcare Insurance Complexities

Research from the National Bureau of Economic Research highlights that health insurance markets are inherently complex, with numerous variables and nuanced details that can overwhelm consumers. Insurance agents play a crucial role in simplifying this process. They help clients understand different plan structures, coverage limits, network restrictions, and potential out-of-pocket expenses.

For individuals approaching Medicare eligibility or seeking marketplace plans, agents provide invaluable support. They break down intricate policy language, help clients anticipate potential healthcare needs, and recommend strategies for maximizing insurance benefits while managing costs.

Moreover, insurance agents serve as ongoing resources. They assist clients during policy renewals, help navigate claim processes, and offer guidance when healthcare needs change.

Their expertise transforms what could be a complicated and stressful experience into a more manageable and transparent journey toward appropriate health coverage.

Their expertise transforms what could be a complicated and stressful experience into a more manageable and transparent journey toward appropriate health coverage.

Why Insurance Agents are Essential for Healthcare Choices

Health insurance decisions are complex and high-stakes, making insurance agents invaluable guides through an intricate landscape of coverage options. Research from the Milbank Quarterly emphasizes that these professionals enhance market efficiency by providing critical information that individual consumers often lack.

Bridging Information Gaps

Insurance agents serve as crucial translators of complex healthcare terminology and policy nuances. Their expertise helps individuals make informed decisions by:

- Decoding complicated insurance jargon

- Identifying potential coverage gaps

- Matching personal health needs with appropriate plans

- Providing objective comparisons across multiple insurance offerings

These professionals go beyond simply selling policies. They act as strategic advisors who understand the intricate details of healthcare coverage that might overwhelm the average consumer.

Personalized Healthcare Navigation

The Commonwealth Fund’s research highlights how agents significantly influence beneficiaries’ plan choices, particularly for Medicare enrollees. They offer personalized guidance tailored to individual health circumstances, financial situations, and future healthcare expectations.

For individuals facing significant healthcare transitions like retirement or chronic condition management, agents provide strategic insights that can potentially save thousands of dollars. They help clients anticipate future medical needs, understand cost structures, and select plans that balance comprehensive coverage with financial affordability.

Moreover, insurance agents continue supporting clients beyond initial enrollment. They remain accessible resources for policy questions, help navigate claim processes, and assist with policy adjustments as personal health needs evolve. Learn more about our expert guidance services and how we can simplify your healthcare coverage journey.

How Insurance Agents Navigate Policies and Plans

Health insurance policies represent intricate financial and medical protection strategies that require sophisticated understanding. According to the Centers for Medicare & Medicaid Services, insurance agents play a critical role in translating complex policy details into actionable insights for consumers.

Comprehensive Policy Analysis

Navigating insurance policies involves a multifaceted approach where agents systematically evaluate numerous factors to recommend optimal coverage. Their analytical process includes:

- Examining an individual’s specific health history

- Assessing potential future medical requirements

- Calculating potential out-of-pocket expenses

- Comparing coverage limits and network restrictions

- Evaluating prescription drug formularies

Detailed policy comparison requires agents to understand nuanced differences between seemingly similar plans. They leverage their expertise to uncover hidden costs, coverage limitations, and potential gaps that might not be immediately apparent to consumers.

Strategic Plan Selection

Research from the National Bureau of Economic Research indicates that insurance agents significantly impact healthcare market efficiency through their strategic plan selection processes. Agents do not simply match clients with available plans but create personalized coverage strategies that align with individual health needs, financial constraints, and long-term wellness goals.

For Medicare beneficiaries, marketplace participants, and individuals seeking supplemental coverage, agents provide critical insights into plan structures. They help clients understand complex terminology, potential coverage exclusions, and strategic enrollment timing that can maximize benefits and minimize financial risks.

Moreover, agents remain actively engaged beyond initial plan selection. They continue monitoring policy changes, help clients during annual enrollment periods, and provide ongoing guidance as healthcare needs evolve. Discover how our expert team can simplify your insurance journey and provide personalized healthcare coverage recommendations.

Key Concepts in Understanding Insurance Agents’ Functions

Insurance agents represent a critical bridge between consumers and complex healthcare coverage options. According to Healthcare.gov, these professionals are licensed experts trained to help individuals navigate the intricate world of health insurance with precision and personalized guidance.

Professional Classification and Credentials

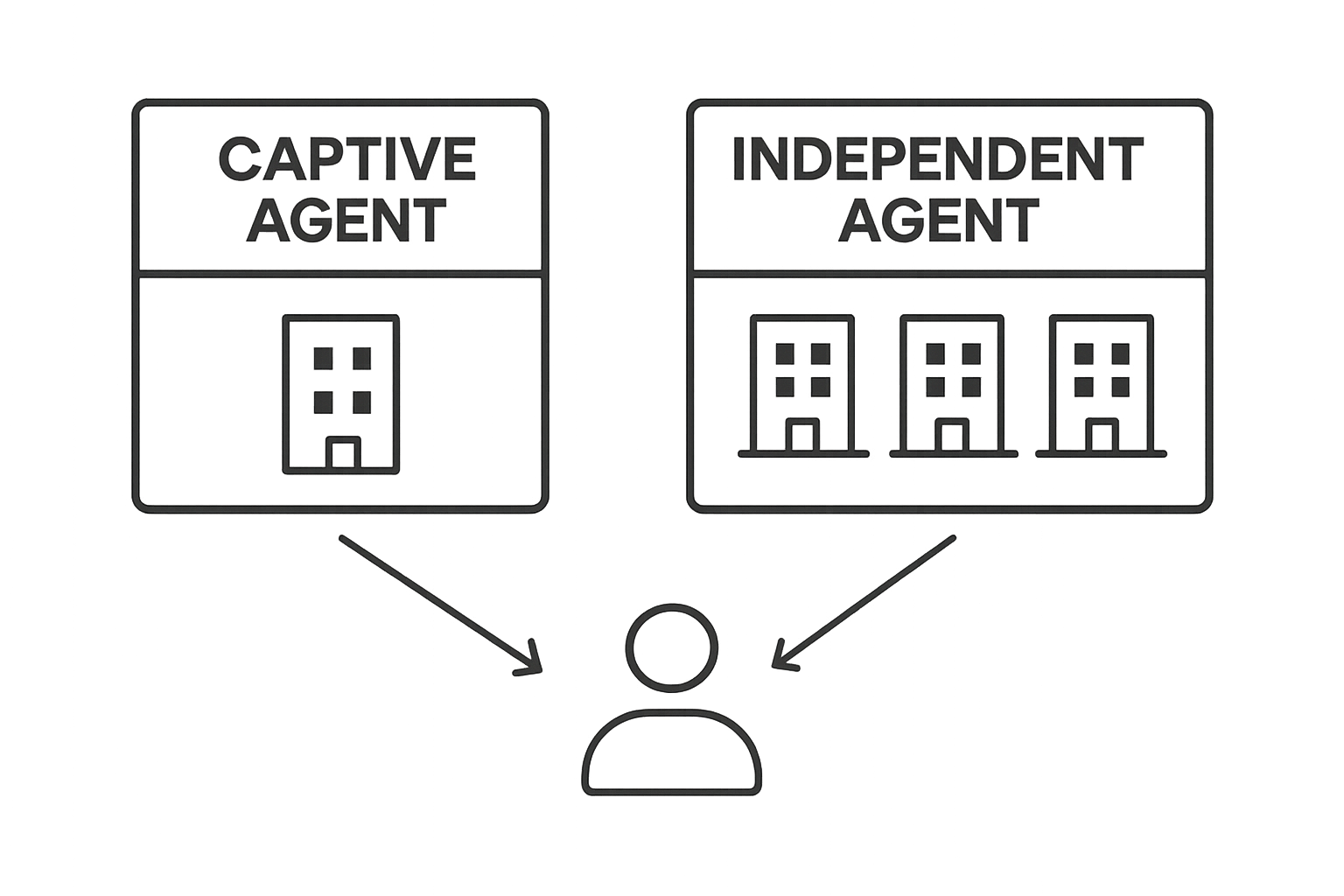

Insurance agents operate within a structured professional framework with distinct categories and responsibilities. There are two primary types of agents that consumers should understand:

- Captive Agents: Represent a single insurance company

- Independent Agents: Work with multiple insurance providers

- Licensed Professionals: Required to complete state-mandated training and certification

Each agent type brings unique advantages to consumers. Captive agents possess deep knowledge about their specific company’s offerings, while independent agents can provide broader comparative insights across multiple insurance providers.

The following table compares the core characteristics, advantages, and limitations of the two main types of insurance agents discussed in this article.

| Agent Type | Represents | Key Advantages | Limitations |

|---|---|---|---|

| Captive Agent | Single insurance company | In-depth knowledge of company-specific plans | Limited to one provider’s offerings |

| Independent Agent | Multiple insurance companies | Offers a wide range of plan options from several companies | May have less detailed knowledge about each provider |

Compensation and Service Models

The U.S. Bureau of Labor Statistics explains that insurance agents typically receive compensation through commissions generated from policy sales. However, this does not translate to additional costs for consumers seeking their expertise.

The agent’s primary value lies in their ability to translate complex insurance terminology into understandable recommendations. They help clients identify coverage that matches specific health needs, financial constraints, and long-term wellness objectives. Their compensation model incentivizes finding the most appropriate coverage rather than simply selling the most expensive plan.

Moreover, agents provide continuous support beyond initial enrollment. They assist clients during policy renewals, help navigate claim processes, and offer guidance when healthcare needs change. Learn more about our comprehensive insurance guidance services and discover how professional support can transform your healthcare coverage experience.

Ready for Confident Healthcare Choices? Let GenerationHealth Guide You

Making the right health insurance decision can feel overwhelming. As highlighted in ‘Understanding the Role of Insurance Agents in Healthcare,’ sorting through complex policy language, comparing endless options, and fearing hidden costs can create anxiety and doubt. You deserve an easy path to understanding terms like coverage limits, network restrictions, and out-of-pocket expenses—without feeling lost or pressured.

Take charge of your healthcare journey today. GenerationHealth.me connects you with instant quotes and expert support so you can navigate Medicare, Marketplace, dental, and vision plans—all in one trusted place. Our professionals are here to answer your questions, compare your choices, and help you avoid common pitfalls. Explore our step-by-step enrollment guidance or get started now at GenerationHealth.me and experience personalized help that brings clarity and confidence to your coverage decisions. Now is the time to secure the plan that fits your life.

Frequently Asked Questions

What are the primary functions of insurance agents in healthcare?

Insurance agents serve as intermediaries between consumers and insurance providers, helping individuals navigate complex insurance options, analyzing healthcare needs, and providing personalized recommendations based on client-specific requirements.

How do insurance agents help simplify the health insurance process?

Insurance agents decode complicated insurance terminology, compare multiple plans, identify potential coverage gaps, and provide ongoing support to clients, making the overall decision-making process more manageable.

Why are insurance agents important for Medicare enrollees?

Insurance agents offer tailored guidance for Medicare enrollees, helping them understand their options and select plans that align with their health needs and financial situations, ultimately enhancing their healthcare experience.

What types of insurance agents are available, and how do they differ?

There are captive agents who represent a single insurance company and independent agents who work with multiple providers. Captive agents have in-depth knowledge of their company’s offerings, while independent agents can provide a broader range of options for comparison.

2 Responses